tv Nightly Business Report PBS April 16, 2013 6:30pm-7:00pm EDT

6:30 pm

>> this is "nightly business report,". brought to you by thestreet.com. multi-media tools for an ever changing financial world. our dividend stock adviser guides and helps generate income, real money helps to think through ideas for investing and trading stocks. action alerts and a charitable trust portfolio that provides trade by trade strategies. online, mobile social media. we are thestreet.com. >> stocks rebound and the market bounces back from the worst one-day decline and now our

6:31 pm

attention turns to technology. as intel and yahoo shows an increase. >> are red flags being raised on one part of the recovery. >> and gold rush, what are individuals doing now with the metal's prices fl s fluctuating. i'm bill, in for tyler matheson, another big day for the markets. but we have two numbers that will set the tone for tomorrow. >> we are talking technology now for a change. a tale of two different earnings stories. yahoo surged 36% and intel fell 26%. they are the first batch of conditi companies reporting. intel earned 40% a share.

6:32 pm

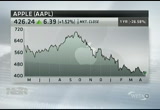

revenues fell 2% to $12.6 billion, slightly better than expected. but the company said that revenues in the current quarter will come in higher than forecast, so their shares jumped as much as 2% after trading. yahoo earned a 38% a share. 14 cents more than expected and revenues came in below estimates at $1 billion and the company reported a drop in display advertising. yahoo shares tumbled in after hours trading. on the heels of the mixed results, there's another technology giant set to report next week that may reveal about the shift about with consumers to mobile computing. in our installment of earnings spotlight. we see what investors are expecting and hoping to hear from apple.

6:33 pm

>> if there's one tech company to focus on, it's appear he he will. >> it's an important quarter for the iphone and ipad maker, investors would like an a crease to the dividend. it's at a 2.5% yield. they would like something closer to 4. the stock is trading near the lowest level because of the worries of the days of profitability of the company being over. expectations for the march quarter keep racheting down, because we are in the middle of a product refresh vacuum. right? but it's not only the march quarter that investors are concerned about. they are concerned about the june quarter that may show more signs of a slow-down as existing, iphone 5 and ipad strt to show age and in front of the next launch of the products. >> apple has already poured cold water on wall street's hopes for surprise up side, saying that sales will be up to around $42 billion. and margins will be down and unlike in the past, this time

6:34 pm

management promises those projections will prove accurate. a key story line to watch with the stock, pc versus mobile. pc's are under pressure with sales down, as consumers opt for phones and tablets instead. ask people how often they are buying a new home computer. >> never, i have a mac, i have ipad and we get new rounds of those every couple years. but no pc except at work. >> i think i use my ipad more than i use my computer to where it's almost obsolete. >> bottom line, investors aring

6:35 pm

keep believing. joining us now to talk about the earnings from intel and yahoo and the out look for the technology sector. is the portfolio manager of the t-rowe price technology fund. the thing that ties the companies egg together, they are about two companies trying to reinvent themselves. in the case of intel, does it have what it takes to reinvent itself, and jump start the company. and in the case of yahoo, is the turn around strategy works? >> thank you for having me on. it's nice to be with you. you hit the nail on the head, both are reinvention stories. -- intel, the segment that they sell into, the pcs are under a lot of pressure. i smiled in the segment leading into this. people are not using their pcs

6:36 pm

as much as they did in the past. so, i think intel does have what it takes to turn around eventually but it will be a slow process to establish themselves in the smartphone and tablet market. yahoo is going through a turn around and what we saw this quarter was not much evidence of a fundamental turn around in yahoo's business with revenues down a bit year on year, so tato one is still on the come as well. >> are we going to get to a time where we do not use pcs anymore. i know we are going to mobile technology. but will there be a day when we we do not have pcs and who is better positioned in that regard, intel or yahoo? >> in that regard, yahoo is better positioned. i think it's an exaggeration to say we will not use pcs. but we will use them for more narrow application. at home, pulling out the

6:37 pm

smartphone to check on video and news, will be what we pull out. yahoo has a better chance to make the transition. and intel is establishing themselves into a new realm. >> i want ask you about apple. you heard the report on it everyone is looking to the earnings report next week. i know that you are a believer in apple. but make a case, why investor who is have lost some faith in this company should take a fresh look at apple? >> well, we all love apple products. the customer that you interviewed, sounds like my house at home. we have macs and ipads and the products are very intuitive. they have a great software eco system, we have come to expect innovation from apple and i think we will continue to see it in the future. you know, just because they have gone through a bit of a lull

6:38 pm

here let's not throw the baby out with the bath water. it's easy to forget that apple has generated tremendous profits and has over $130 billion on their balance sheets right now. >> it seems that their innovation has been more incremental. what do you think is their next big thing? >> hard to say. i think they will continue to innovate around the iphone and ipad products. i think we will see thinner ipads can and larger screen iphones and new things like fingerprint sensor. we have heard of them working on apple tvs and watches. i think people would use the watches while they are jogging or being at the gym. and there's a lot of people that

6:39 pm

would buy the apple tv to solve the nightmare of the cable box. >> do you own any of the stocks? >> apple is the largest position in the fund that i manage and we do own apple personally in our family as well. >> all right. thanks so much. josh spencer. bill? >> he well, the markets rose sharply today, gaining back more than half of monday's big losses. the dow was up 157 points. nasdaq up 48, and the s&p 500 added 22 points. stocks got a big boost from a round of solid economic data reports and stronger than expected earnings from dell, dow components, coca-cola and john and jo johnson and johnson. and there was a 4% decline in prices at the gas pump. helping, industrial production

6:40 pm

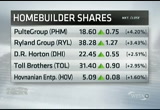

was higher than forecast in march. with u.s. automakers churning out more new cars and trucks and utilities, combatting a nationwide cold snap that we suffered from last month. and good news in housing. construction of new homes shot up by 7% in march. enough to reach an adjusted annual rate of 1 million housing units for the last month. something we have not seen in five years. >> bill, that jump in new home building sent shares of the nation's biggest home builders higher. ryland up 3.5%. and others have all seen gain. much of the surge in construction was not single family homes however. but multi-family rental apartments. it's a sector that has been growing rapidly over the past few years and now there's concern about a backlash in all those rental units that are hitting the market all at once. diane explains.

6:41 pm

>> as the market for single family homes recovers, a curious contradiction, rental apartments are going up in demand, but soon could be going down. sales are up 82% from a year ago. running at a pace -- >> we will be seeing winds for the space. and the supply trojectory is changing. and the path way to home owner ship loosening. vacancies fell from 5% a year ago. that pushed rents higher by 3%.

6:42 pm

despite sluggish job and wage growth, consumers are willing to pay the higher rates. >> it's takiing two to three years to put up an apartment. and that fears on investor fears. >> what we have seen in the multi-spaces is relative under performance to the rest of the market. a big part of that is fear around supply. there's a concern around rental growt growth. >> real estate is all about location. and those inner urban areas are saying the market is hot but not over heated. >> i think the market is ripe for us to take advantages of the locations we are. >> new apartment units are set to open with a stronger surge

6:43 pm

set for 2014. >> that is how the system works. one market suffers and the opposite market is hot. >> the whole american dream of owning a home. americans want to rent. it's easier. >> they are doing it in big droves right now. still ahead the gold rush, all the volatility causing individuals to hoard or unload precious metals. let's look at how the international units closed today.

6:44 pm

>> as we mentioned earlier in the program, strong earnings from two dow components helped to set the table for today's market rally. coca-cola's earnings topped estimates thanks to strong sales volume in the u.s. and worldwide and johnson and johnson also reported better than expected earnings on sales of newer medicines. investors bid up coke more than 5.5% to more than $42 and johnson and johnson gained more than 2% to $83 a share. >> goldman sachs and black rock gained points. goldman's chief financial officer said that the clients

6:45 pm

were cautious and black rock's chief executive officer said that new business was indicative of positive momentum. black rock gained more than 1 with % while goldman sachs lost nearly 2%. shares at j.c. penney jumped 5.5% today on a report that the troubled retailer is considering ways to borrow against the real estate by issuing date. jcp closed at $15.19 a share. >> and whirlpool announced a dividend increase, saying that they expect a sustained growth. all the new homes coming out will need aappliances they sell kitch kitchen-aid and maytag products. they were up better than 3% today alone. >> one of the stars of the market was ww granger. it sells equipment and supplies

6:46 pm

to other companies and institutions. their first quarter improved by 13% and led the s&p 500 gaining 7.5%. that works out to $16 to $241 a share. and gold prices regained a bit of their glitter today, up $26 an ounce but that is coming off the biggest one day drop in prices in 33 years on monday. with prices falling $140. if you own gold, even old jewelry that you are thinking of selling for cash. you may be wondering if now is the time to sell. jane wells takes us to a california company, where prices for gold and silver are creating a rush of customers. >> we have 23 kilos and 365 eagles. it's late afternoon at the

6:47 pm

investment company where customers are buying or selling gold and silver. >> volatility brings them in. they need to act now. he is a partner in the gold dealing, >> until the recent drop, that was the end of last week, beginning of this week, i would say that we were selling more. especially silver. >> you were selling. >> we were selling more. okay. now that has balanced out. we have seen more sellers come in the market in the last couple of days. >> one man that did not want to talk on camera was selling more than 1600 ounces of gold. but most of the people were buying. john garden is buying silver at the moment and waiting to buy more gold. >> obviously it will go down another $100 and then it will start its way back up. >> at this facility, they will buy american gold eagles for about $25 above the market price for gold. and sell them for $75 over.

6:48 pm

as for silver, they buy at 1.25 and sell for 3.25 over, but they do not have much silver to sell at the moment. >> most of the business here is done through the mail. about 20% is conducted in person. and cni's 18 employees are busier than normal. >> when there's big moves and lots of volatility, they act right away. friday the market could be different. >> and here, no matter what is happening with the price of gold. they are making money. for "nightly business report." >> the tricky thing about selling jewelry is that it's just for its weight not for the design or any special stones, it is a gold rush. >> that value. coming up, the business of protecting big encvents and the cost to keep you safe and more on how the commodities and

6:49 pm

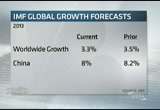

treasuries and currency faired today. >> brace yourself for slower growth around the world. 3.3% is the new economic growth number. it lowered the economic out look by 2.5%, blaming steep cuts in the u.s. economy and the deepening crisis in europe. they cut china's growth to 8% from 8.2%. >> a slow down in gdp in china

6:50 pm

got the blame. but ford does not see it that way, they are protecting that 40% of the sale s will come fro china. they have doubled their capacity, scrambling to keep up with demand to keep up with the market. we have a closer look at ford's rapid expansion there and the challenges it faces. >> he is part of the new wave in china. car buyers turning the western part of the country into one of the hottest auto markets in the world. >> translator: in his mind, he feels that the car, the brand is good. and the service is also excellent. so this is why he trusts this brand. >> here, the gateway to western china, growth in auto sales is particularly good news for ford. at this plant, a new focus roles

6:51 pm

off the assembly line every minute and within two years ford will be doubling capacity in the area. >> this year, the total volume of the ford, were 600,000. so it's a big, big key. >> growing sales in china have been one of the top goals since he took over ford in 2006. at the time, ford had a small presence in china. while its rival led the market, gm, thanks to chinese buyers loving buicks. they began investing in china and now they generate 11% of ford's global sales with "the focus" leading the way. >> they have the focus being announced as the number one selling vehicle in the world and the number one selling vehicle in china. what a proof point about the ford strategy. >> while ford is surging in china.

6:52 pm

it is still barely a blip in the rear view mirror of the market leaders. >> the dominant players here are of course volkswagen, and hyundai is a story as well in terms of how well they have done. so ford is still behind but coming on strong. >> the running hot in the world's hottest auto market. where buyers are embracing the blue oval. >> in many ways china is 50 to 60 years behind us in that they have a large growing middle class in their country and it is a sweet spot for companies like ford and general motors. >> they will turn in their bicycles for cars. >> yes, ma'am, they are. and a lot of them. >> our series from china starts tomorrow. >> from expansion on the roads to trouble in the skies. american airlines and american

6:53 pm

eagle grounded all flights today after a computer outage at the reservation system. 900 flights were impacted and another 800 were impacted by planes and crews not making the destination. the computer problems have been fixed and all flights will rule this evening but to expect a lot of delays before things get back to normal. >> and speaking to getting back to normal. after the dead many bombings on monday, many americans are worried about enhancing security measures at any public event. at what is likely the first high profile gathering since the boston tragedy, officials acted quickly to soothe the concerns of the public despite the cost. >> there were marching bands. pipers, and soldiers on parade instead of on patrol.

6:54 pm

it hardly seems like a day after the terrorist attack, but the parade went on as plans right down pennsylvania avenue. they maintained a heavy security presence today in washington, d.c., not a lot of visible security, the normal police presence is out and about here in washington, but the folks we talked to here today said it was an important day to come out the and they were not going to be afraid. >> it's pretty safe place to be at this point. >> how did it feel today? >> i feel pretty safe. i do. >> 151st signing of the emancipation proclamation. and it was scary, but it was an important gesture to come out and support it. >> these spectators were determined to come out and show they were not afraid. even though the republican representatives said that

6:55 pm

security has laxed. >> we are newly reminded that serious threats to our way of life remain. >> securing the big events that america loves is expensive. whether it's in times square or new orleans. the nfl spent $6 million on security for the super bowl and obama's inauguration came with a $124 million security price tag and there's no guarantee that it will always work. >> my sense is, for something like this, you could not possibly have frisked everybody in boston before the marathon or looked in every trash can everywhere. no matter what security officials do, life and the parade will go on. for "nightly business report." >> and that's it for us, "nightly business report" thanks so much. have a great evening, everybody. we will see you tomorrow.

142 Views

IN COLLECTIONS

WETA (PBS) Television Archive

Television Archive  Television Archive News Search Service

Television Archive News Search Service

Uploaded by TV Archive on

Live Music Archive

Live Music Archive Librivox Free Audio

Librivox Free Audio Metropolitan Museum

Metropolitan Museum Cleveland Museum of Art

Cleveland Museum of Art Internet Arcade

Internet Arcade Console Living Room

Console Living Room Books to Borrow

Books to Borrow Open Library

Open Library TV News

TV News Understanding 9/11

Understanding 9/11